OSINT for Traders: Using of OSINT to Make Informed Trading Decisions

“The Benefits of OSINT for Traders: How to Use Publicly Available Sources to Make Informed Trading Decisions”

As a trader, you are constantly looking for ways to stay ahead of the market and make informed trading decisions. One tool that can be especially helpful for traders is OSINT, or Open Source INTelligence.

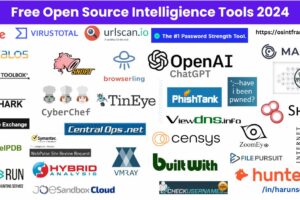

OSINT is the practice of gathering information from publicly available sources. This includes sources such as social media, websites, news articles, and more. OSINT can be a valuable tool for traders because it allows them to gather a wide range of information quickly and efficiently.

Here are a few ways that traders can benefit from OSINT:

- OSINT can help traders stay up-to-date on market trends and developments. By using OSINT to track news and social media activity related to their investments, traders can stay informed about the latest developments and make more informed trading decisions.

- OSINT can help traders identify potential opportunities and risks. By using OSINT to gather information about companies, industries, and economic conditions, traders can identify potential opportunities and risks and make more informed trading decisions.

- OSINT can help traders gather competitive intelligence. By using OSINT to gather information about competitors and the market landscape, traders can gain a competitive edge and make more informed trading decisions.

- OSINT can help traders evaluate the credibility and reliability of different sources of information. By using OSINT to evaluate the credibility of different sources, traders can make more informed trading decisions based on reliable and accurate information.

It’s important to note that OSINT is not the same as intelligence gathered through covert or clandestine means. As a trader, you need to be mindful of legal and ethical considerations related to gathering and using publicly available information.

Overall, the benefits of OSINT for traders are significant. By using it effectively, traders can stay up-to-date on market trends and developments, identify potential opportunities and risks, gather competitive intelligence, and evaluate the credibility of different sources of information. This can help traders make more informed and profitable trading decisions.